In 1957 a group of eight people did something that both earned them a wonderful collective moniker the “Traitorous eight”, but also arguably started the most American of industries, Venture Capital.

Traitorous Eight is a very cool nickname, but come on…

Venture Capital, I happen to think, is one of the greatest things in modernity and a defining element of American economic power and expansion.

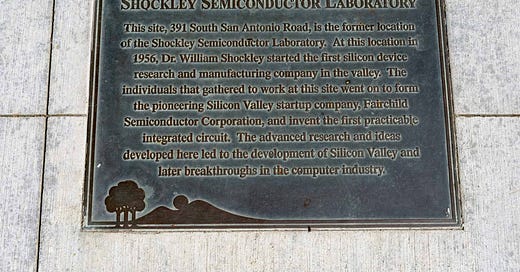

Long story short, these eight engineers chafed under working under Nobel Prize winner William Shockley, who has since been “characterized” as autistic or paranoid (perhaps this made him a poor boss) and with the help of a New York based financier Arthur Rock started their own company, Fairchild Semiconductors.

Fairchild became, more or less, the current company known as Intel, but I’m going to resonate on Arthur Rock’s creation.

American Venture capital.

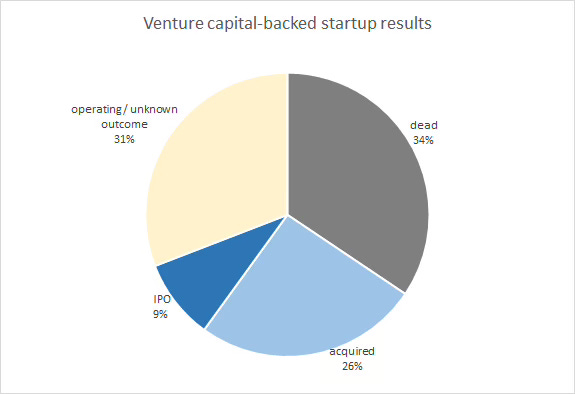

Venture capital, to set definitions, is early stage investing that has to live outside of banks (and their hatred of risk,) friends and families (and their limited access to capital) and Government (which isn’t built for anything but governing (if that,)) It’s not an expansive industry, nor a collective easy skill, but when it accomplishes great things.

Here is just a trifling of a quick list of companies that have benefited from Venture Capital. Try to think of the world without their contributions:

Genentech, Apple, Nike, Intel, Google, Sephora, Moderna, PayPal

How does VC do this? Through the collective evaluation of people, risk, ideas and markets.

People:

Venture Capital offers opportunity to leaders like Elon Musk or Steve Jobs whose psychological profile is decidedly unlike that of a typical MBA or JD graduate.

Risk:

Ideas:

I tend to think that if the founders of Google went into a bank or applied for a small business loan (if the brick and mortar requirement did not exist) with an idea of ranked search listings they would have been laughed and dismissed. Genentech helped bring about artificial insulin on mass levels because they had this far-fetched idea of partnering with pharmaceutical companies. An idea that traditional investors couldn’t comprehend.

Markets:

Going back to our original there was no silicon chip (much less a Silicon Valley!) before Fairchild, no scalable manufacturing process for transistor manufacturing. Arthur Rock believed in the promise of that market.

Venture Capital is, in many ways, a uniquely American thing. There are some International success stories (SoftBank, Legend,) but to me it is the personification of the “American Dream” It is democratic, it emphasizes the individual, the pursuit of new markets and groundbreaking ideas.

It creates jobs, wealth, convenience and does so with efficiency and unique parameters. It’s often derided, I am sure, because of the concentrated aggregation of wealth (which is a problem), but I don’t think it is celebrated enough.